Distressed funds in the real estate sector

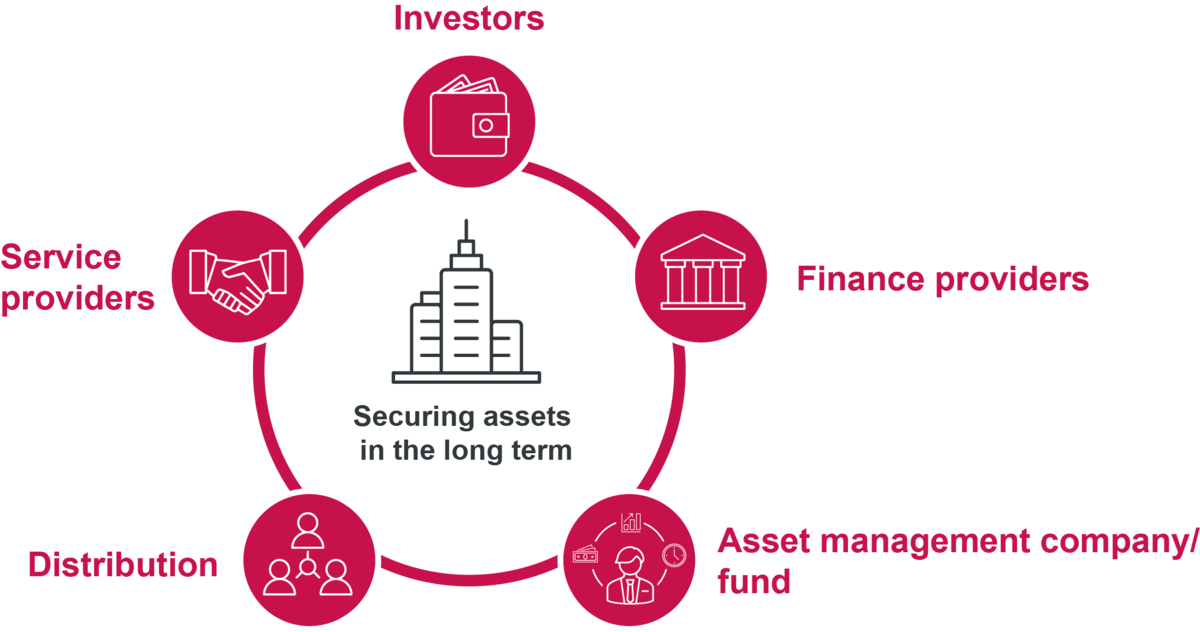

The real estate sector is currently facing tremendous challenges, and real estate funds and their managers are increasingly finding themselves in distress. Headlines such as “Financial supervisory authority orders AIFM into insolvency” or “Another multi-billion euro real estate fund comes under pressure” illustrate this vividly. In times of economic uncertainty, the affected stakeholders share a common objective: the sustainable protection of their assets. In our analyses, we consistently take into account the conflicting interest of various stakeholders.

Rising interest rates, increasing regulatory requirements, supply bottlenecks and a shortage of skilled labour are only some of the factors that have driven the real estate market into a fundamental crisis. The consequences include stagnation in the investment market, a sharp decline in new construction activity, and the devaluation of real estate assets. Stakeholders face considerable uncertainty. A domino effect looms, with the potential consequence of significant losses in asset values.

As a full-service law firm, Luther is your ideal partner in addressing these challenges. Our experts support affected stakeholders in safeguarding their assets – both proactively and in times of crisis. We are familiar with the problems and challenges involved in balancing conflicting interest in turbulent times. You can benefit from the lessons learnt by our experienced specialists from the 2008 financial market crisis.

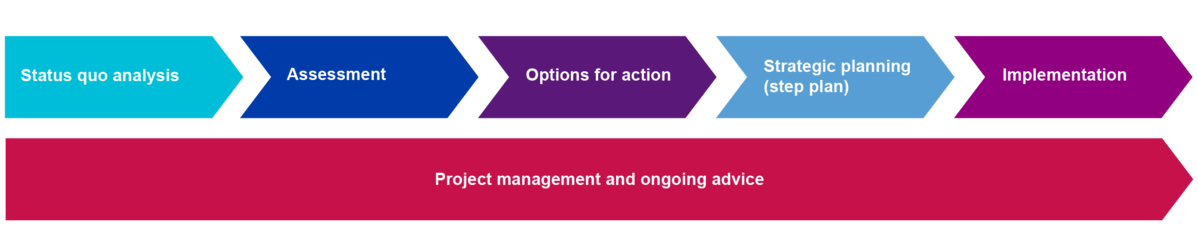

Professional excellence and deep market penetration constitute our core competencies. Our primary working tool is the Health Check. Whether applied preventively or in the context of crisis management, we pursue a structured approach:

Areas of advice

In times of crisis, various stakeholders pay particular attention to the resilience of asset managers and their products. Both are indispensable when it comes to trust, reputation and competitiveness.

Our experts assist you in protecting the assets and financial products under your management and in mitigating insolvency risks.

We analyse fund structures and assess your legal position in relation to potential stress scenarios, including liquidation, suspension and insolvency scenarios and the associated liability risks. We develop optimisation strategies aiming to stabililise liquidity, reposition your products, and defend against liability.

Our team analyses your service provider structures and identifies which rights must be strengthened to ensure the proper exercise of your management functions and to enable the Investment Fund to be steered in and through crisis.

In addition, we develop communication strategies that are essential in times of crisis vis-à-vis investors and supervisory authorities and train your employees and service providers on potential risk factors in Fund management.

For institutional investors, safeguarding their assets is of utmost importance.

Our experts analyse the legal framework regarding your investment and support you in evaluating and mitigating potential risks of loss.

We provide you with a detailed explanation of the often complex legal structure of the Investment Fund, outlining your specific rights as an investor (such as information and participation rights) and demonstrate how you can exercise them effectively to mitigate risks.. With regard to your legal position, we analyse potential optimisation strategies to stabilise your Fund investment (e.g. concerning leverage and service provider structures) and assist you in your communication with Fund Managers, supervisory authorities and other third parties (such as umbrella Fund investors).

We assess potential claims for damages or other legal remedies against managers, current or former board members, co-shareholders or third parties and ensure their efficient and effective enforcement before both state courts and arbitral tribunals. In addition, we advice on enforcement measures as well as on negotiating restructuring arrangements with the creditors of the investment vehicles.

A crisis in closed- or open-end Real Estate Investment Funds also affects the service providers who, on the basis of a corresponding contractual agreement, manage the Fund´s properties and ensure the preservation of their economic value.

We analyse your contractual situation vis-à-vis the Fund Manager and, in the light of a potential property devaluation or insolvency of the Imvestment Fund or Fund management company, identify ways to minimise your liability risks and safeguard your financial interests. We also assess your potential corporate links to the Fund product and advise you on liability and insolvency law aspects.

We support you in negotiations with the Fund Manager and collaborate with you to develop an effective investor communication strategy.

In the event of a distressed Real Estate Investment Fund, the distribution of Fund shares also comes into focus – particularly in Funds involving retail investors. Law firms specialising in consumer protection are already engaging in intensive client acquisition efforts in order to pursue alleged compensations claims on broad scale.

Our experts are highly experienced in capital investment law. For you as an investment advisor or investment broker, we asses

potential liability risks in distributing Fund shares and help you to minimise future liability risks, for example by training your sales staff.

In addition, our experienced litigators support you in defending against claims for damages or recourse both in individual and collective proceedings. In doing so, we make use of modern legal tech applications and AI in close cooperation with our Luther Solutions team.

The challenges in the real estate market also affect the financing banks. Our experts review the existing financing structure and advise credit institutions on any necessary adjustments, follow-up financing, and financial restructurings.

Where required, we assert the rights arising from existing financing agreements and ensure the effective and efficient enforcement of claims. Of course, we also provide advise on the realisation of collateral or enforcement measures. We have particular expertise in creditor-led M&A processes involving solvent liquidation of investment vehicles. Luther ensures the protection of your assets – precisely and reliably.

News

Key Contacts >>