10.03.2020

Luther.Automotive - Effects of the Coronavirus on the Automotive Industry

With Auto China in Beijing and the Geneva Motor Show, two of the industry's major leading trade fairs were recently cancelled. The corona virus (officially now christened "SARS-CoV-2" by the WHO) is also affecting many companies outside China and the Wuhan epicentre. The emergency measures taken by the Chinese government have paralysed large parts of the Chinese economy, and production is only slowly starting up again in some cases, even weeks after the Chinese New Year. As a result, demand in and from China has collapsed massively, as has traffic there.

Many German companies have been severely affected and the automotive industry is suffering particularly from the consequences of the epidemic. The automobile manufacturers and suppliers are already struggling with the slowdown in the automobile economy, the shift to electromobility and other challenges, and the corona virus is coming at an inopportune time. China is the most important sales market and production location for the automotive industry, so the industry has immediately felt the effects of the epidemic. In addition to the sometimes dramatic slumps in sales, car manufacturers and suppliers are confronted with a host of new issues, especially in the areas of HR, "health compliance" and supplier relationships.

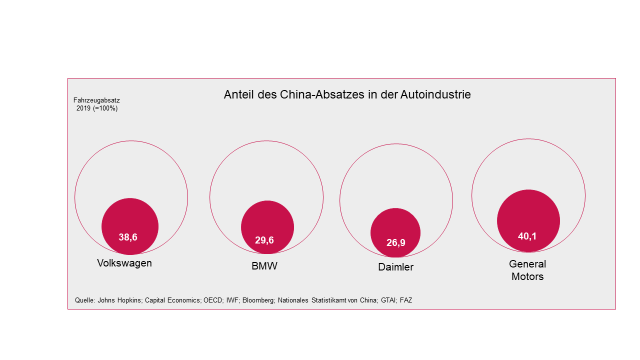

China is by far the most important sales market for German car manufacturers, who produced almost 5 million cars in China in 2019. VW delivers about 40% of the cars produced worldwide in China, other manufacturers have a similarly high share.

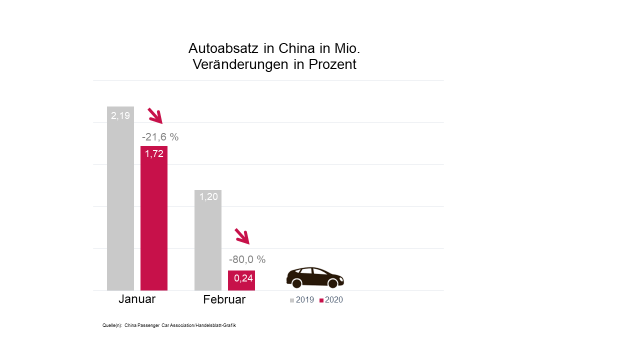

While SARS had led to a boom in new car registrations in China in 2003 - many Chinese citizens preferred to drive their own cars rather than using public transport for fear of infection - car sales in China plummeted in the first few months of the year as never before since the data were collected.

The car market almost completely collapsed, most dealers were closed in the weeks after the spring festival and there was hardly any demand for new cars. Intensified efforts in online sales have also had little effect so far, and the Chinese industry association PCA expects demand to remain very weak until at least the end of the first quarter, before there is likely to be a "bounce-back" in car purchases.

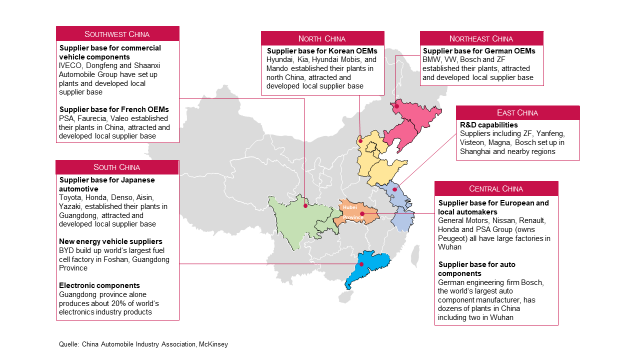

The virus is already having a serious impact on global supply chains. Many primary products and components come from Chinese production and many suppliers have experienced and continue to experience supply bottlenecks due to plant closures and logistics disruptions. The crisis area of Hubei Province with its capital Wuhan is one of the centres of Chinese car production. Almost two million cars are manufactured there every year, which is about 8% of the total vehicle production in China. Foreign car manufacturers such as GM, Renault or Honda and suppliers such as Bosch also have plants there (see map below) and more than 700 automotive suppliers are located in Hubei Province (VW alone has 39 suppliers from the crisis region with its SAIC joint venture).

Practically all major car manufacturers (including VW, BMW and Daimler or their joint venture with Chinese state-owned corporations) have extended their plant holidays after the Chinese spring festival, sometimes for several weeks. VW had recently postponed the start of operations once again because of delays in resuming nationwide supply chains and because many employees could not return to their workplaces due to travel restrictions. Many plants are still producing at very limited capacity. Logistics within China is still severely restricted, in some cases so-called "travel passes" are still required to transport goods to other provinces, and drivers do not even head for certain regions for fear of infection or the threat of quarantine.

In the first few weeks, the plants in China were particularly affected, but due to the lack of production there and other disruptions in the supply chain, the effects outside China are also becoming increasingly apparent. Shortly after the Chinese New Year, reports of production stoppages were received from Korea, and in Europe a Fiat Chrysler plant in Serbia was shut down at the beginning of February due to a lack of deliveries from China. The car manufacturers Land Rover and Jaguar as well as suppliers such as Continental or ZF have announced that urgently needed parts for production will be brought from China to Europe by plane if necessary, and not by ship as is usually the case. Most plants in Germany still seem to be running without major disruptions, but the quarantine orders imposed on Northern Italy over the weekend give an unpleasant foretaste of what the German car industry may still be facing.

An important aspect for companies at the moment is the question of liability and possibly claims for damages in the event of delayed delivery because, for example, suppliers from China or now also Italy are unable to deliver in accordance with the contract or they themselves are no longer able to fulfil their obligations. The contractual agreements are decisive here. Here, it is always first of all necessary to check which law actually applies between the business partners, i.e. German, Italian or Chinese law. In any case, it is important to know whether the contract contains a force majeure clause and what its exact content is. If not, the legal regulations may apply. In German and Chinese law, force majeure is understood as an external event that was not foreseeable at the time of the conclusion of the contract and is unavoidable and insurmountable. Epidemics count as cases of force majeure in addition to war, natural disasters and the like in general. In China, the resolution of the State Council of 24.01.2020 also clarified that the epidemic of the novel coronavirus is a case of force majeure.

If this is a case of force majeure, the company concerned is not responsible for a delayed delivery and the associated damage. In this case, the contracting party may not claim damages if he himself suffers loss due to late delivery. The invocation of force majeure presupposes that the prevention of timely performance of the contract was directly caused by the force majeure. There shall be no release from liability if the contract was not concluded until after the outbreak of the epidemic or if the party affected by force majeure was already in default with its performance when the event occurred. Even if the virus epidemic is classified as a case of force majeure, this does not mean that it is the cause of any refusal to perform and that any debtor can invoke it. There are no blanket answers here. In any case, the contractual partner must be informed of the situation in good time in order to protect it from consequential damage. In addition, Chinese law requires the submission of evidence, such as a certificate from the Chinese Foreign Trade Association CCPIT, within a reasonable period of time.

According to an economic survey by the DIHK (German Chamber of Industry and Commerce), one in two German automotive suppliers is planning to cut back on investments and cut jobs, especially because of the switch to electric drives, and sales losses or recourse claims due to the corona virus have a doubly heavy impact on the accounts. Before the outbreak of the epidemic, many analysts predicted a recovery in car sales in China in 2020. In the meantime, this is likely to be a waste of time and the structural crisis in the automotive industry is likely to worsen in the coming months until the virus is contained. Ferdinand Dudenhöffer (previously Director at the Center for Automotive Research at the University of Duisburg-Essen and soon at the University of St. Gallen) expects that one month of business interruption in China will mean a loss of sales of around EUR 2.5 billion and a loss of around EUR 300 million for the German automotive industry. The China Association of Automobile Manufacturers estimates that, as a result of the virus, car production in China in 2020 could be one million vehicles down on the previous year. A study by the University of St. Gallen predicts a 3% decline in car sales worldwide this year and as much as 8% in China.

About two months after the outbreak of the coronavirus, the situation in China is gradually returning to normal, with many provinces having reduced the strict quarantine measures from level one to two or three. Here, catch-up effects on car purchases can also be expected as soon as the virus has been brought under further control and consumer confidence has returned. In the USA and Europe, on the other hand, the epidemic appears to be just beginning. At the latest with the weekend entry and exit ban for northern Italy, German personnel and legal departments are also in crisis mode.

Further information on the legal implications can also be found on the coronavirus topic page on our Luther website: https://www.luther-lawfirm.com/newsroom/newsletter/detail/coronavirus-rechtliche-auswirkungen-auf-unternehmen

Luther is organising a webinar on 11 March together with the OAV and WMP-AG on "Update Coronavirus - Answers to Legal and Strategic Questions from the Practice". German and Chinese legal experts from Luther Rechtsanwaltsgesellschaft will report directly from Shanghai on the current situation and provide practice-oriented recommendations for the currently most urgent legal issues. Participation in the event is free of charge, but requires registration: here https://register.gotowebinar.com/register/1323703552859519233.

Thomas Weidlich, LL.M. (Hull)

Partner

Cologne

thomas.weidlich@luther-lawfirm.com

+49 221 9937 16280