07.08.2020

Luther.Automotive - Corona Update China: Partnerships in Demand for new Technologies

Authors: Thomas Weidlich, LL.M. (Hull) and Eva König, MBA

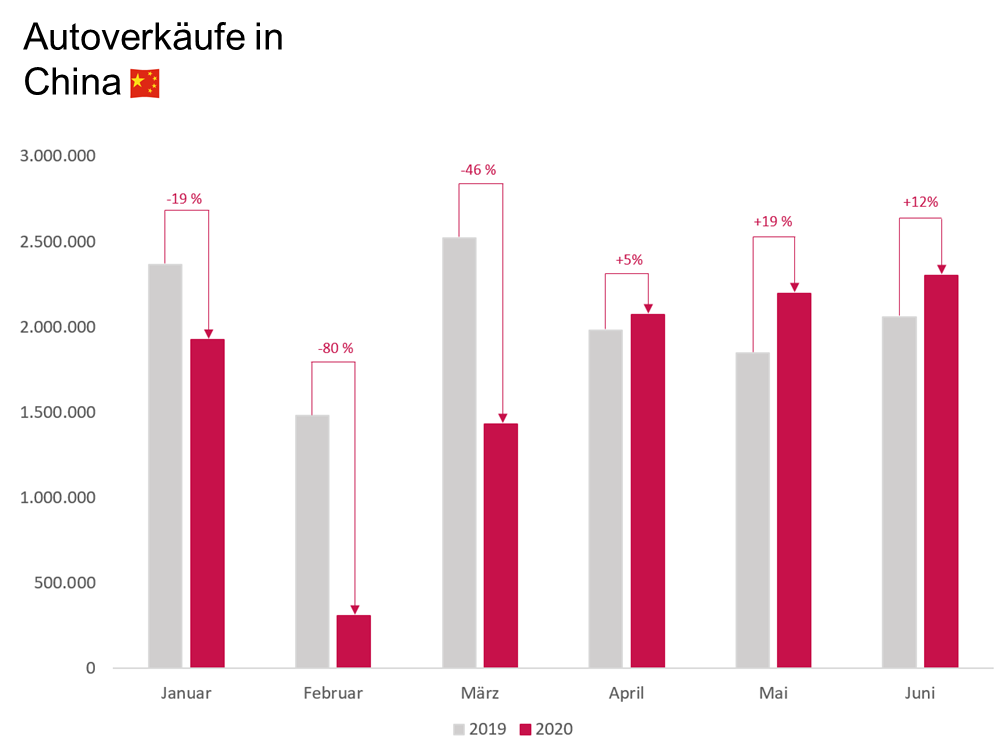

China has been the world's largest car market for seven years and is considered to be the motor of the global automotive industry. More and more Chinese manufacturers and start-ups are entering the market with innovative products. In 2019, China produced more than a quarter of all passenger cars worldwide and had by far the largest share in global passenger car production. However, even in China, after 30 years of growth, sales figures have been declining since 2018 and the car market will shrink this year for the third year in a row in the wake of the coronavirus crisis. The following article is a continuation of our blog Effects of the Coronavirus on the Automotive Industry of 10 March 2020 and deals in particular with the latest developments in the fields of new energy vehicles (NEV) and intelligent connected cars (ICV).

Source: Statista 2020

The China Association of Automobile Manufacturers (CAAM) estimates that, as a result of the coronavirus, car production in China in the year 2020 in total could be one million vehicles below the previous year and sales could drop by up to 15%. Nevertheless, confidence prevails that China will be able to make up for the slump caused by the COVID-19 pandemic and get back to its dynamic growth path that it had followed until 2017. Since the coronavirus crisis, even more Chinese people prefer to use their own car because of the increased risk of infection when using public transport. In addition, the expansion of electric bus and electric taxi fleets in the public sector in particular is considered an important driver of market recovery. The current figures confirm this upward trend. After motor vehicle sales (excluding electric cars) in China slumped by more than 40 percent in the first quarter of 2020, some growth has been recorded again since April.

Car Sales in China

Sources: CAAM; BCG Report 2020 "Automotive demand post COVID-19"; Luther (own research)

Motor vehicle production in China has essentially resumed, even though there are still bottlenecks for some parts and components supplied from abroad. In general, the premium segment seems to be coming through the crisis better, probably because wealthy population groups were less affected by the pandemic and their purchasing power is still high. All in all, many experts see a much faster recovery of the automotive industry in China than in Europe, even though China has introduced rather few direct corona aid schemes compared to other countries. Although the central government in Beijing and the government authorities at provincial and local level have taken numerous measures to promote business and introduced a number of measures to stabilise the economy and support the ailing labour market, these measures are rather peanuts compared to the massive aid packages of the Western industrialised countries. Specific support measures for the automotive industry in China that has been hit by the crisis include an increase in new car registrations in certain cities (e.g. Shanghai, Hangzhou and Shenzhen) as well as the extension of the subsidy programme for vehicles with alternative propulsion systems (NEVs) until 2022 or the waiver of the 10% purchase tax.

The impact of the pandemic on global supply chains has been severe. Many primary products and components are produced in China and many suppliers experienced supply bottlenecks due to plant closures and transport interruptions. Almost 80% of the global automotive supply chain is connected to China in one way or another. In some cases, there are still delays and disruptions to normal business operations, partly because many employees have not been able to return to their places of work due to travel restrictions. The entry ban for foreigners into China will remain in place until further notice. The return of necessary personnel is possible to a limited extent within the framework of the so-called "fast-track" agreements between China and Germany. A new regulation of 20 July 2020 also requires travellers to undergo a coronavirus test before departure for China.

Some experts assume that the trend towards regional production will increase due to the massive disruption to global supply chains caused by the pandemic. However, we do not believe that we will see a huge number of cases, where production will be relocated from China to other countries. Admittedly, many companies had already started to build up additional production capacity in South East Asia in countries such as Vietnam, Malaysia or the Philippines before the coronavirus crisis. Back then the reasons were that they wanted to avoid rising labour costs in China and higher customs duties in the wake of the trade dispute with the USA as well as reduce their dependence on just one country. Being located in various countries would allow them to react more flexibly, if necessary. At the same time, however, most companies no longer produce in China for cost reasons alone, but primarily to serve the important Chinese market locally. Therefore, most foreign companies already producing in China will continue to do so.

China is the world's largest sales market for alternative drive vehicles (New Energy Vehicles / NEVs). This market includes not only e-vehicles and plug-in hybrids, but also hydrogen fuel cells, synthetic fuels, etc. The growth in this area is based on targeted subsidies by the Chinese government to make alternative propulsion vehicles affordable for consumers in urban transport; in addition, a significant proportion of purchases are encouraged by government demand (administration, taxi, etc.). Since 2014, this sector in China has been state-subsidised through sales bonuses and tax incentives for hybrid and pure electric vehicles. These were initially due to expire in 2020, but were extended to 2022 due to the coronavirus crisis. Even though the requirements have been relaxed somewhat due to the slowdown in industrial growth and the pandemic, the Chinese government is maintaining its ambitious targets, which are forcing all manufacturers and consequently also suppliers to step up their efforts in developing and selling new drive systems. The goal declared by the Chinese Ministry of Industry and Information Technology (MIIT) is that by 2025, new energy vehicles (NEV) should already account for 20% of all vehicles sold. To this end, a points system with an e-quota and strict requirements regarding emissions (max. 4 litres/100 km on fleet average by 2025) was introduced. Manufacturers receive a certain number of negative or positive points, which are continuously adjusted according to the model. The points are awarded according to a complex formula, ultimately negative points from vehicles with combustion engines must be balanced by positive points from NEV. The NEV quota should be at least 18% of the total fleet by 2023 (the requirements have been relaxed somewhat due to COVID-19).

The coronavirus crisis highlights the advantages of autonomous driving. Transport vehicles without a driver can be used to maintain logistics even in areas severely affected by the epidemic, disinfect and clean roads, deliver drugs to hospitals and highly infectious patients, and supply people with food during lockdowns, etc. By the end of February, at least 13 companies, including Huawei, JD Logistics and Zoomlion, had deployed low-speed unmanned vehicles in some Chinese cities to fight the epidemic. Especially at a time when many people fear contact with others or an infection with COVID-19 during a ride on public transport, unmanned robotaxis become increasingly attractive.

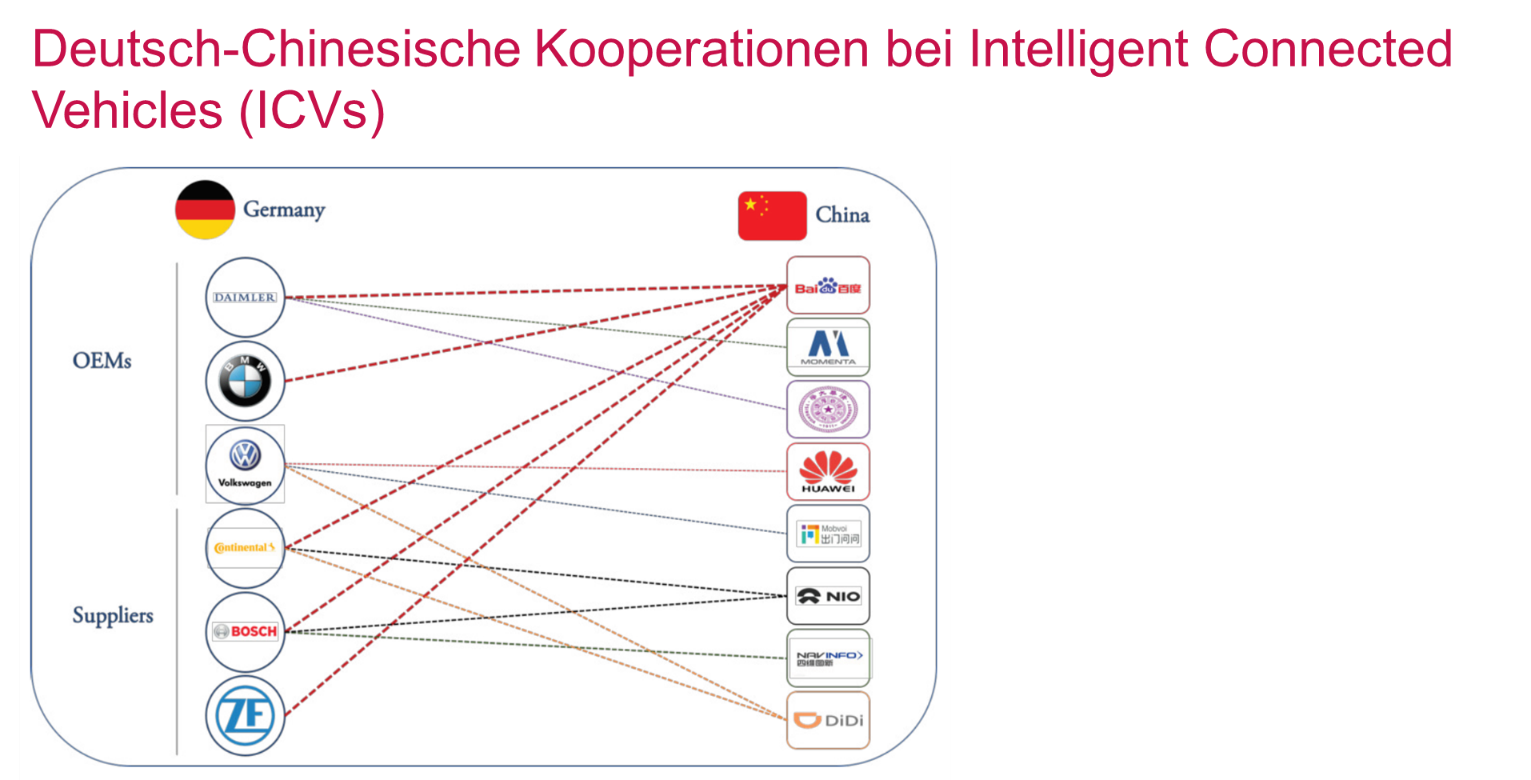

Similar to the NEVs, China is also a pioneer in intelligent connected vehicles (ICVs) with clear strategic guidelines, as is Germany. China aims to be the market leader in autonomous driving and networked mobility by 2030. Even during the coronavirus crisis, China backed this plan; on February 10, 2020, the National Development and Reform Commission (NDRC) published its "Smart Car Innovation Development" strategy, which calls on various ministries to formulate guidelines and measures to promote the development of intelligent cars. In addition, the cooperation of domestic and foreign companies in China is to be promoted, as well as corresponding cooperation abroad. However, foreign investors will only be able to serve the Chinese ICV market with a Chinese partner, such as the large Internet groups Baidu, Alibaba or Tencent, with whom they have to jointly develop systems that work in China, or they have to share their own systems with Chinese partners. A well-known example is the Apollo platform managed by Baidu, in which more than 100 domestic and foreign companies are involved, including Daimler, Bosch, Continental and BMW. The alternative may be to rely entirely on software developed in China, but even then a large part of the technical ICV infrastructure will have to come from local companies that want to benefit from the expertise of the foreign car manufacturer or supplier and of course want to be paid for using their systems.

Sino-German Partnerships in the Field of Intelligent Connected Vehicles (ICVs)

Source: GIZ (2019) "Defining the Future of Mobility: Intelligent and Connected Vehicles (ICVs) in China and Germany”

The coronavirus crisis has also hit the automotive industry in China hard. China was the first country to be affected by the epidemic, but was able to recover relatively quickly from the effects, thanks also to rigid measures. The automotive sector is also showing signs of an upward trend. However, travel restrictions still prevent foreign companies from resuming normal business operations in China. Despite the massive disruption to global supply chains, we are unlikely to see any massive relocation of production out of China. Most companies in China produce locally for the Chinese market. Despite the pandemic, China is sticking to its ambitious goals for alternative drive vehicles and autonomous driving and aims to become the market leader in the near future. Therefore, the corresponding subsidy programme has been extended once again. At the same time, the pandemic has highlighted the benefits of new developments such as robotaxis. They offer new opportunities for domestic and foreign companies in China. However, foreign investors will only be able to serve the Chinese ICV market with a Chinese partner such as the large Internet groups Baidu, Alibaba or Tencent. Anyone who wants to be part of the game in the world's largest automotive market will have to establish partnerships.

Thomas Weidlich, LL.M. (Hull) and Eva König, MBA

Thomas Weidlich, LL.M. (Hull)

Partner

Cologne

thomas.weidlich@luther-lawfirm.com

+49 221 9937 16280