06.10.2023

11th Amendment of the German Competition Act gives the Federal Cartel Office far-reaching powers of intervention

Last Friday, the so-called “Competition Enforcement Act” was passed by the upper house of the German parliament (Bundesrat). In approving the bill, the representatives of the federal states have decided not to act upon the continued concerns of business associations and numerous experts (see our comments on the original draft version here and here). This thereby concludes the legislative process. The 11th amendment of the German Act Against Restraints of Competition ("ARC"), which has been the subject of controversial discussions during the legislative process, will enter into force the day after its publication. This is expected to happen within the next few weeks.

According to the Federal Ministry for Economic Affairs and Climate Action (“BMWK”) - the Ministry responsible for the amendment throughout this process – the intention of the adopted changes, is to ensure "more competition in distorted markets". According to the Federal Minister Robert Habeck, the new regulations are the "biggest reform [of antitrust law] since Ludwig Erhard" (Erhard being former German chancellor and alleged architect of the “economic miracle” in post-second world war Germany). According to Habeck, the amendment will give the Federal Cartel Office ("FCO"), the "claws and teeth" it needs to improve the competitive situation in "entrenched and encrusted sectors with structural problems”.

The draft legislation was revised several times during the legislative process. Compared to the original government draft, the adopted amendment contains a number of clarifications and additional procedural safeguards. However, whether these will ensure predictable, transparent and appropriate action by the FCO remains to be seen.

In any case, the changes likely mark a groundbreaking reform of German antitrust law:

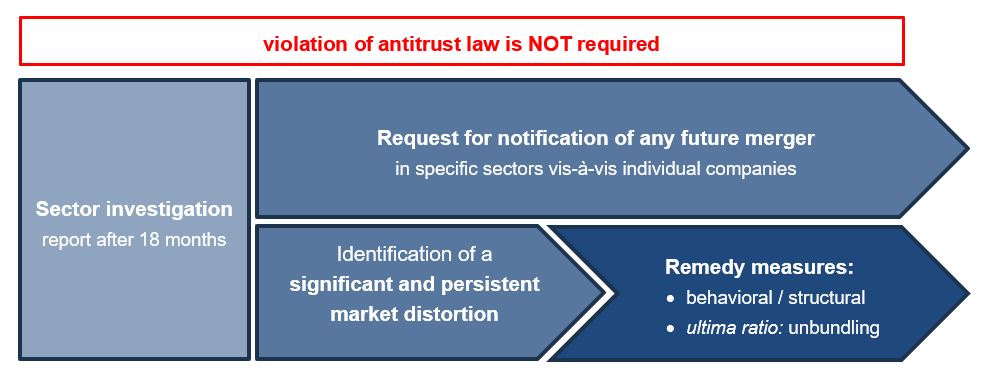

Most importantly, Section 32f ARC assigns the FCO an additional power of intervention. In its press release of August 23, 2023, the BMWK calls the instrument a "new, fourth pillar of German competition policy". This Section means that in the future, the FCO will be able to troubleshoot “significant and persistent” market distortion identified in a sector investigation, by imposing various remedies – irrespective of any antitrust violation by the companies concerned. The new intervention instrument is therefore independent of abuse or any other violation of law. The possible behavioral and structural remedies also include – as ultima ratio – unbundling orders against dominant companies.

In addition, the changes introduced by the 11th ARC amendment facilitate the disgorgement of benefits in the event of cartel violations (new paragraph 4 in Section 34 ARC). The newly introduced Section 32g ACR also authorises the FCO to carry out investigations and investigative measures in the event of possible infringements of the Digital Markets Act ("DMA") under EU law.

Sector investigations have so far served to investigate and analyse the structures and competitive conditions in specific sectors of economy. They focused on obtaining information for the FCO and creating a data basis for the possible initiation of further proceedings. In the past, many of these investigations have taken an inordinate amount of time. Until now, they have regularly been concluded with a report by the FCO. , with no further direct consequences envisaged. Where the FCO had found (suspicions) of illegal anticompetitive behaviour, the FCO could then initiate individual proceedings against the undertakings concerned, however, with the full fledged burden of proof and the “ordinary” instruments to stop them.

This is now changing.

As was previously the case, the FCO can still conduct a sector investigation if "circumstances suggest that domestic competition may be restricted or distorted" (Sec. 32e para. 1 ARC). What is new, is that the so-called Monopolies Commission now has the power to issue recommendations for the conduct of sector investigations (Sec. 44 para. 4 ARC). Whilst these are not binding, the FCO must issue a statement if it does not follow such a recommendation. According to the new acceleration provision inserted in Sec. 32e para. 3 ARC, the sector investigation "shall" be completed within 18 months, , and the FCO is obliged to publish a report on the results. This is significant, as this was previously merely a discretionary power).

What is particularly interesting, however, is the newly added Section 32f ARC, which grants the FCO far-reaching powers of intervention following the sector investigation:

Request for notification of future concentrations

Under Sec. 32f para. 2 ARC, the FCO can for a period of three years, and by formal decision, require individual companies to notify any merger in the sector under investigation, if there are "objectively verifiable indications that future concentrations could substantially impede effective competition in Germany".

This only covers mergers in which the buyer generated domestic sales of more than EUR 50 million in the last fiscal year, and the target company generated domestic sales of more than EUR 1 million. These thresholds were raised by the Parliament’s Committee on Economic Affairs during the course of the legislative process. An order pursuant to Sec. 32f para. 2 ARC can be repeated a maximum of three times.

Section 39a of the ARC, known as the "Remondis clause", which previously contained a comparable regulation, has been deleted.

Remedies to eliminate "significant and persistent” market distortions including unbundling

Sec. 32f para. 3 and 4 enable the FCO to first determine – by way of an order – "that there is a significant and persistent distortion of competition [on one or more markets or across various markets]", to the extent that the authority's other pre-existing powers do not appear sufficient to remedy the distortion effectively and permanently. This declaratory order is issued against those companies who, in a next step, can be considered as addressees of remedial measures. These are companies that, by virtue of their conduct and their importance for the market structure (cumulative requirements), contribute significantly to the market distortion". Sec. 32f para. 5 ARC provides the authority with a number of standard examples and criteria according to which the existence of a competitive distortion shall be assessed. Illegal conduct (such as a anticompetitive agreements or the abuse of dominance) is not required. In addition, the order can be extended to other companies at a later date.

Against these companies, the FCO can then, in a further step, "impose any remedial measures of behavioral or structural nature [that] are necessary to eliminate or reduce the distortion of competition." The conceivable measures are manifold and vary considerably in their depth of intervention. Examples given in Sec. 32f para. 3 ARC include granting access to data/networks/interfaces/facilities, the obligation to establish transparency standards, the imposition of certain contractual arrangements and business relationships (e.g. prohibition of long-term commitments in supply contracts), the obligation to separate company divisions in accounting or organisational terms, or the prohibition of the disclosure of certain information (to prevent tacit coordination). In the case of certain regulated markets (e.g. rail, telecommunications, energy and gas), the measures must be taken in agreement with the Federal Network Agency.

Sec. 32f para. 4 ARC contains the Federal Cartel’s sharpest tool as ultima ratio: dominant companies and companies with outstanding cross-market significance for competition within the meaning of Sec. 19a para. 1 ARC, can be obliged by order to sell company shares or assets if it is to be expected that (only) this measure will eliminate or significantly reduce the significant and persistent distortion of competition. Due to the considerable encroachment on fundamental rights, such an unbundling order is subject to strict conditions: it is permissible if the other remedial measures mentioned above are not possible, not equally effective or (conceivably in individual cases) more onerous for the company concerned. As a further procedural requirement, the Monopolies Commission and the respective competent state cartel authority must be given the opportunity to comment. Furthermore, there is a ten-year protection period for officially approved mergers: assets may not be the subject of an order to divest if they have undergone a final merger clearance by the FCO or the European Commission in the ten years prior to the initiation of the sector investigation.

As the legislation currently stands, the FCO is already authorised by Sec. 34 para. 1 ARC to order the disgorgement of the economic benefit achieved by companies in the event of intentional or negligent infringements of antitrust regulations. The background of this provision is clear: companies should not profit financially from their conduct in violation of antitrust law.

However, the instrument of skimming off an advantage has not played any role in practice so far, as the determination and quantification of the economic benefit gained through the cartel infringement caused considerable difficulties. The previous regulation only stated that the amount of the advantage could be estimated. This is now changed by the newly formulated Sec. 34 para. 4 ARC:

- Firstly, it is assumed that a cartel infringement has caused an economic benefit.

- Secondly, with regard to the amount, it is presumed that the benefit amounts to at least 1 percent of the domestic turnover with the products or services in relation to the infringement.

As before, this is an estimation, whereby the determination of the amount of the benefit according to Sec. 287 of the Code of Civil Procedure is facilitated in that respect that a “predominant probability" of a certain economic benefit is sufficient. The presumption can only be rebutted under qualified conditions. The maximum amount to be seized is 10 percent of the total turnover of the company. The time limits for the disgorgement of benefits remain unchanged (up to seven years after completion of the infringement and only for a time period not exceeding five years).

Last but not least, the newly inserted Sect. 32g ARC empowers the FCO to support the Commission in the (public) enforcement of the DMA. The involvement of national competition authorities in investigations of DMA infringements is already provided for under the EU-Regulation (Art. 38 para. 7 DMA). However, this is only possible if corresponding investigation powers are also granted in the respective national law. This legal basis for intervention has now been created by the new Sec. 32g ARC.

The Commission remains the sole authority with the power to enforce the DMA. However, the FCO can now independently and on its own initiative undertake "all necessary investigations" to detect possible competition infringements in the digital sector (Art. 5, 6 and 7 DMA). These are the same competences as in national antitrust proceedings. Before taking the first formal investigative measure, the FCO must inform the Commission in the form of a written report. The FCO shall then report to the Commission on the results of its investigations.

In addition to the extension of the authority’s investigative competence, the private enforcement of the DMA is facilitated. In particular, the procedural facilitations and concentrations of jurisdiction of the courts applicable to private actions for cartel damages are also declared applicable to DMA violations.

The 11th amendment to the ACR provides the FCO with a unprecedented power of intervention in the history of German antitrust enforcement – even though the final draft contains more safeguards for undertakings which could be subject to the application of the new instruments. It remains to be seen how the FCO will use its newly created "claws and teeth", which Federal Minister of Economics Robert Habeck had wished for; and to what extent it will make use of its – now quite considerable – possibilities of shaping the market (or, as the critics claim “market design”).

Both the initiation of a sector investigation as well as the imposition of the subsequent intervention-intensive remedies are at the discretion of the authority. Therefore, the decisive factor will be where the FCO decides to set its investigative and regulatory priorities. Previous sector inquiries by the FCO have concerned, for example, the waste disposal industry, food retailing and the market for building materials. Sector investigations are currently being carried out in the market for refineries and fuel trading as well as for charging stations for electric vehicles.

Companies in possibly "entrenched and encrusted sectors" must be prepared for strict monitoring of their market and activities. Official intervention against them in the form of remedial measures, including unbundling orders, will be possible even if they behave in compliance with antitrust law.

As a short-term intervention, these measures need not be feared however: in each case, the sector investigation, which generally lasts 18 months, must be completed beforehand. In addition, appeals against all remedial measures have a suspensive effect (the Parliament’s Economic Committee has once again improved Sec. 66 para. 1 No. 1 ARC in this respect), so that companies can effectively defend themselves against such orders.

It should be kept in mind that also in the future, the FCO will be bound to its legal limits and the principle of proportionality. That said, it is not to be expected that the FCO will be intentionally acting ultra vires and frivolously engage in market design (as critics of the amendment fear). However, we may expect fierce discussions before the courts regarding the FCO enforcing the new competition rules “with claws and teeth”.

Dr Sebastian Felix Janka, LL.M. (Stellenbosch)

Partner

Munich

sebastian.janka@luther-lawfirm.com

+49 89 23714 10915

Anne Caroline Wegner, LL.M. (European University Institute)

Partner

Dusseldorf

anne.wegner@luther-lawfirm.com

+49 211 5660 18742

Lara Jaeger

Senior Associate

Berlin

lara.jaeger@luther-lawfirm.com

+49 30 52133 24770

Alexandra Gebauer

Associate

Munich

alexandra.gebauer@luther-lawfirm.com

+49 89 23714 20951